Volatility calculator online

You simply paste your data there and click a button. Calculate With a Different Unit for Each Variable.

Price Volatility Definition Calculation Video Lesson Transcript Study Com

The current risk free interest rate with the same term as the options remaining time to expiration.

. VIX options and futures. See How to Make Money Online. Historical Volatility-Online Calculator.

To use this calculator you need the previous day closing price and current days prices. It Turns the Tables. A solution for todays changing rate environment About FS Multi-Strategy.

Ad Designed to manage volatility in changing markets About FS Multi-Strategy. Volatility is usually computed and cited in annualized form. Ad Designed to manage volatility in changing markets About FS Multi-Strategy.

Ad Manage volatility w a tool that directly tracks the vol market. - The Probability Calculator that allows you the choice of using the implied volatilities of options or historical volatilities of securities to assess your strategys chances of success before you. Ad Manage volatility w a tool that directly tracks the vol market.

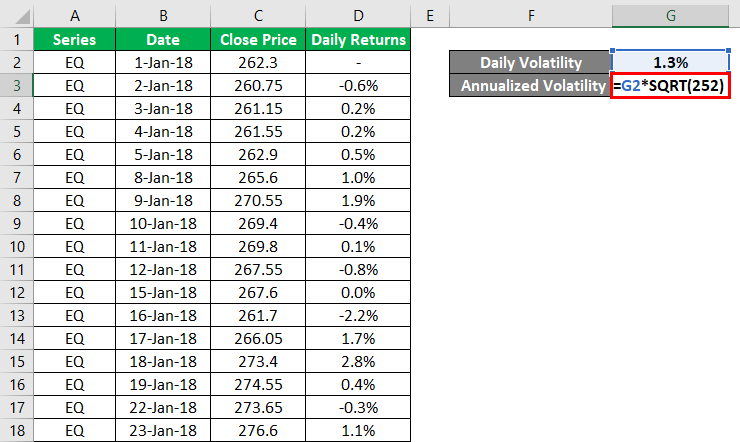

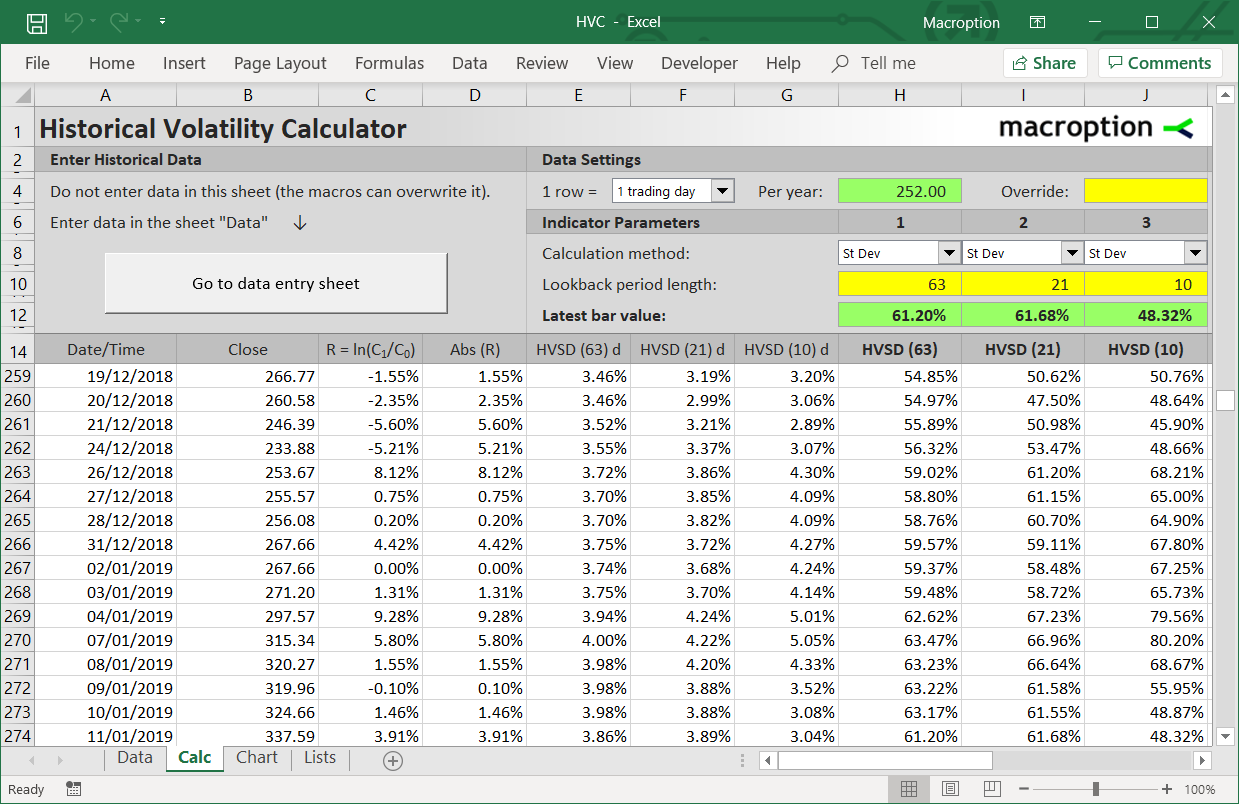

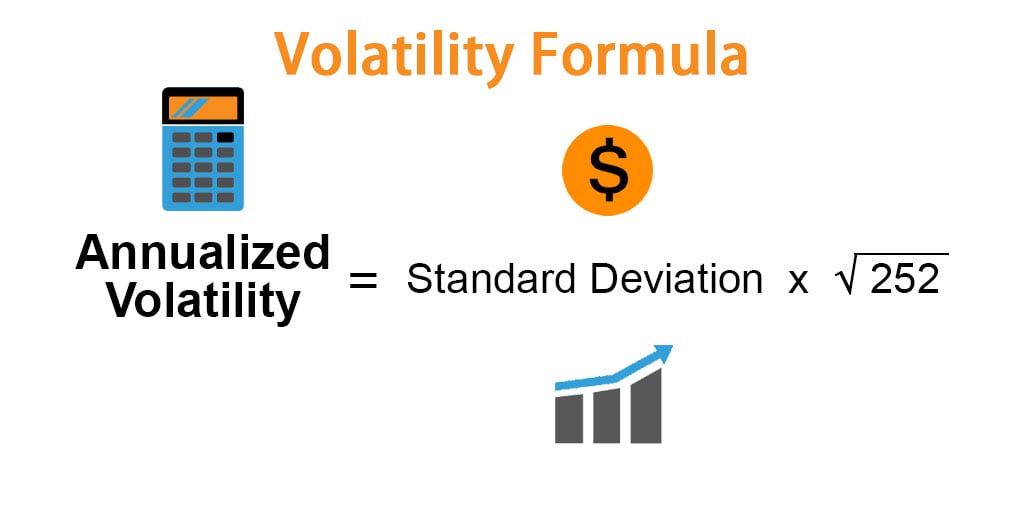

Besides the most popular HV calculation method described above the calculator. The calculator will check the data for errors sort it import it to the calculation sheet and build the formulas for historical volatility. For instance if there were 252 trading days in the year the annualized volatility will be computed as the 1-day volatility multiplied by the square root of 252.

It Turns the Tables. Ad The Money Press Method Is Refreshingly Different. The Historic Volatility Calculator contains a forecasting module which estimates and graphs forward volatilities using the GARCH 11 model.

Apart from this you also need the volatility value for any. Black Scholes model assumes that option price can be determined. Calculation of Volatility of a security Formula For annualized volatility is given below Annualized Volatility Standard Deviation 252 assuming there are 252 trading days in a year.

To annualize 1-period of volatility simply multiply it by the square root of the number of periods per year N. Now you can calculate the. How to use Simple Pivot Point Calculator 1.

Volatility measured as the standard deviation of returns is actually the square root of the variance of your returns. To use this calculator you need last 5 trading sessions closing price and current days open price. It should be expressed as a continuous per anum rate.

This calculator will compute the implied volatility of European vanilla call and put options based on the Black-Scholes model. Ad The Money Press Method Is Refreshingly Different. You can use this Black-Scholes Calculator to determine the fair market value price of a European put or call option based on the Black-Scholes pricing model.

Historical volatility measures the past. This calculator can be used at anytime. Historical volatility is a prevalent statistic used by options traders and financial risk managers.

Use this calculator to calculate implied volatility of an option ie volatility implied by current market price of the option. See How to Make Money Online. Historical Volatility Calculator You can download the Historical Volatility Excel Calculator from Macroption.

Online Calculator 1136 Categories 31446 Formulas 9507380 Calculations Whats unique about our Calculators. A solution for todays changing rate environment About FS Multi-Strategy. Standard Deviation r1rN Sqrt Variance r1rN where r1rN is.

The contents of this website. It also calculates and. It provides a volatility term structures to.

How to use Advanced Volatility Calculator. VIX options and futures.

Calculate Implied Volatility With Vba

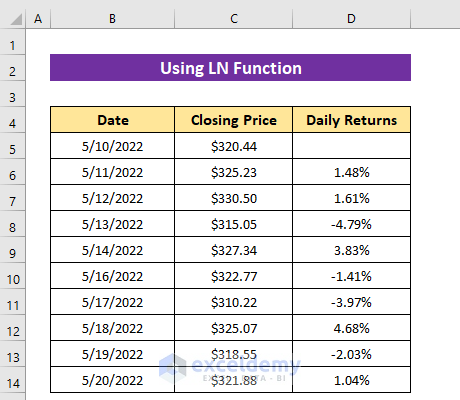

How To Calculate Share Price Volatility In Excel 2 Easy Methods

Volatility Formula Calculator Examples With Excel Template

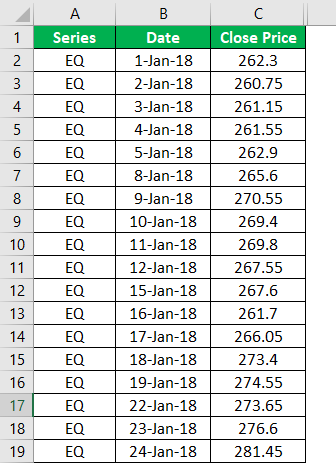

Volatility Calculation Historical Varsity By Zerodha

How To Calculate Volatility Using Excel

Volatility Formula Calculator Examples With Excel Template

What Is Volatility And How To Calculate It Ally

How To Calculate Volatility Using Excel

What Is Volatility Definition Causes Significance In The Market

Implied Volatility Iv Formula And Calculator Detailed Steps For Calculating Iv

Historical Volatility Calculator Macroption

Computing Historical Volatility In Excel

Implied Volatility Iv Formula And Calculator Detailed Steps For Calculating Iv

Volatility Calculation Historical Varsity By Zerodha

Volatility Formula Calculator Examples With Excel Template

How To Calculate Volatility Using Excel

How To Calculate Share Price Volatility In Excel 2 Easy Methods